How Grants Are Made

The Foundation has one major grant issuance cycle annually (for financial grants larger than $5,000.00). The deadline for this grant cycle is July 1. The Foundation will issue annual grants in Quarter 4 annually.

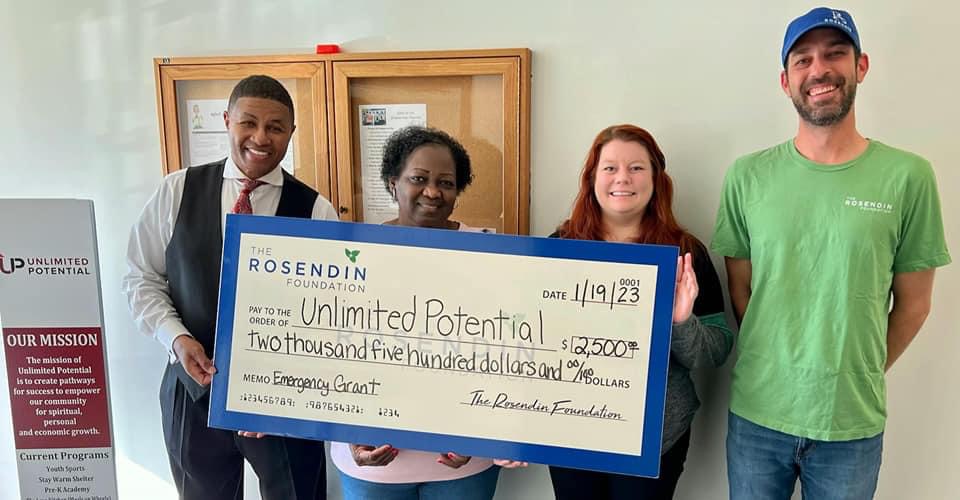

The Foundation also reviews grant applications from qualifying organizations on an as-needed basis for one-time emergency grant requests less than $5,000.00.

Non-profit organizations wishing to be considered for funding must first submit a completed Grant Application, along with copies of the organization’s (or their sponsoring organization’s) 501(c)(3) determination letter and list of current board members. Applicants must be in good standing with the IRS as a 501(c)(3) charitable nonprofit and in good standing with their state.

The Rosendin Foundation confirms IRS good standing, state good standing, GuideStar/Candid rating, and Charity Navigator rating when evaluating applicants. We recommend that your organization confirm its good standing with each in advance of applying.

Our grant making committee reviews all qualified grants and makes recommendations to The Rosendin Foundation Board of Directors. Staff notify grant applicants by email approximately two weeks after the board meeting if their application has been funded, denied, or held for consideration during the next grant cycle.

Funding Exceptions

In general, The Rosendin Foundation does not provide financial support for:

- Organizations that discriminate on the basis of race, ethnicity, color, religion, gender, gender identity or expression, sexual orientation, ability/disability, age, status as a veteran, national origin or any other protected class;

- Political candidates, organizations, committees, or lobbying efforts;

- Activities, programs and/or capital expenditures affiliated with a religious organization;

- Scientific research;

- Projects for an individual school;

- Grants to subsidize participation (scholarships or loans) or re-granting programs;

- Reimbursement for purchases or activities that occur prior to grant decisions;

- For singular grant requests greater than $50,000;

- Multi-year or ongoing annual funding requests for an organization;

- To underwrite the costs of fundraising events, such as luncheons, dinners, golf tournaments, bowl-a-thons, charity runs, etc.

- Programming outside of Rosendin and MPS’ geographic and office locations

- Organizations not in good standing with the IRS and Secretary of State’s office of the state where the nonprofit provides services and seeks funding.

Important Grant Application Info

1) Verification of Tax-Exempt Status. Applicants must be able to verify their 501(c)(3) status by submitting a copy of their tax determination letter from the Internal Revenue Service. There are no exceptions to this policy, and no other types of tax-exempt organizations will be considered.

2) Verification of Current Address. The address on the tax exemption letter must match the current address of the organization. If it does not, the organization must submit a copy of the first sheet of its most recent Form 990 filing showing the current address of the organization. If the organization is not required to file a Form 990, it may alternatively submit to the Foundation a letter, signed by the Executive Director or other official with authority to bind the organization, explaining the change of address (when, where, etc.) and affirmatively stating that, but for the change in address, the organization is the same organization that has been designated by the IRS as a 501(c)(3) organization, that there has been no change in that status since the issuance of the IRS letter and that, to the best of the writer’s knowledge, there are no circumstances that would warrant a change in that status.

3) Recognition as an Affiliate of another Organization. If the organization applying for a grant is an affiliate of a parent organization that holds 501(c)(3) tax-exempt status, the applicant must submit a copy of the parent organization’s tax-exemption letter along with a letter from the parent organization, on the parent organization’s letterhead, recognizing the affiliate and confirming the affiliate’s current address.